Category: Blog

Xero pricing update 2023

From 13 September 2023, the price of Xero Business plans in New Zealand is changing: Starter plans are increasing to $33 per month Standard plans are increasing to $71 per month Premium Plans are increasing to $94 per month Ultimate plans are increasing to $105 per month The price of...

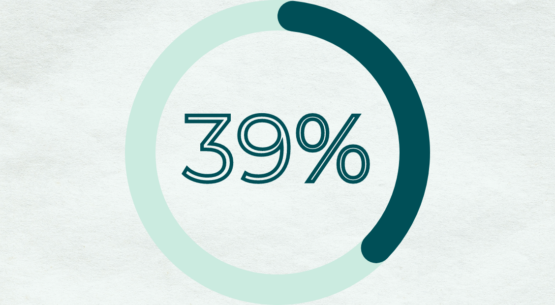

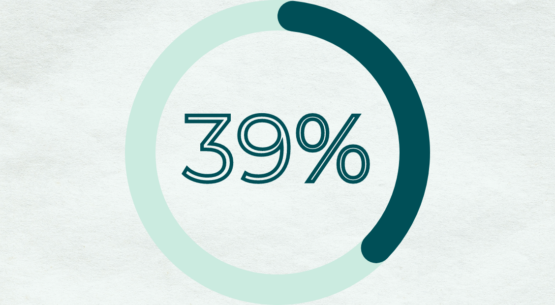

New top tax rate for trusts – what does it mean for you?

Budget 2023 contained a few surprises, but the change to the tax trust rate wasn’t one of them. Being hinted at a few times, Grant Robertson lifted the tax trust rate from 33% to 39%, bringing it into alignment with the top personal income tax rate. This change is from...

The ‘No frills’ 2023 budget – What does it mean for you?

What’s in this Budget for the Kiwi business owner? From trust taxes to apprenticeships, to avoiding a recession, we look at the items most likely to impact you. How will the latest Budget affect your business and your household? Here are some of the changes most likely to have an...

Managing Farm Debt – Budgeting, Forecasting & Planning

If you’re feeling uncertain about your next year of farming, you’re not alone. Farmer confidence is low, with more than 11% of respondents to a Federated Farmers survey expecting profit to drop over the next year. How you handle cash flow is important to suppliers and lenders, so even if...

Provisional Tax: What You Need To Know

What is Provisional Tax? Provisional tax is income tax paid in advance of the end of the financial year, or paid as you go. And, it’s important to get it right. We’ll help work out what’s best for you and your business. If you are an employee, your employer sorts...

GST Special Alert – What do I have to do before 1 April 2023?

New rules on GST invoicing apply from 1 April 2023. Make sure your business is ready to cope with the changes. Even though the new GST invoicing rules still allow ‘tax invoices’ to be issued after 1 April 2023, make sure you think about: Your accounts payable processes. Do...

NZ GST Invoicing changes from April 2023

New Zealand GST invoicing and record-keeping requirements apply from 1 April 2023. All businesses need to be aware of the changes to ensure their business processes can manage the new requirements. New rules modernising GST invoicing and record-keeping requirements apply from 1 April 2023. The key change is removing...

What are your business goals for the year ahead?

What are your business goals for the year ahead? Conducting a past-year review with an experienced advisor will provide valuable insights for this year's goal-setting. What will you do differently this year to enable your business to thrive? The beginning of a new calendar year is an excellent time to...

Entertainment Expenses – Income Tax and GST

The rules and exemptions for entertainment expenses can be complex. If you're not sure, check with us on common types of expenses and their tax treatment. As a general rule, if you provide entertainment for your team or clients, some of your business entertainment expenses are tax deductible. Some examples...

Key financial numbers to focus on in your business

What are the key reports to focus on in your business? We'll show you how to track performance, take action and prepare your company for surviving the new business normal. As a business owner, it’s never been more important to have a good grasp on your finances. For many businesses,...