Covid-19 Information

If you have been financially impacted by the 2022 COVID-19 traffic light settings, there are now two types of business support payments and one loan that may apply to you, these are outlined below. REMINDER: Your tax agent cannot complete these applications on your behalf as the applications require a legal declaration to be made.

SCROLL TO

Short-term Absence Payment (STAP) NOW CLOSED

Small Business Cash Flow Scheme (SBCS)

COVID 19 Support Payment (CSP)

Wage Subsidy Scheme (WSS) – NOW CLOSED

Resurgence Support Payment (RSP) – NOW CLOSED

Short-term Absence Payment (STAP): NOW CLOSED.

Payment Amount: One-off payment of $359 per eligible worker. Can only be applied once every 30 days per eligible employee.

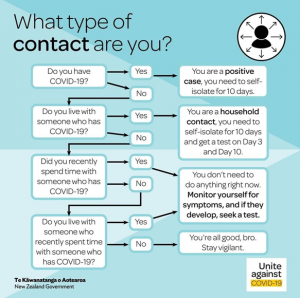

Eligibility Criteria: This is for employees who are staying at home while waiting for a COVID-19 test result, parent/caregiver of a dependent who is staying home while waiting for a COVID-19 test result or are a household member/secondary contact of a close contact who is staying at home while waiting for the test result of the close contact. To be eligible, workers need to be unable to work from home and need to miss work while waiting for their test results. Only PCR tests taken on or before 22 August 2022 will be accepted. You can only apply for this payment up to 8 weeks after your PCR test.

Leave Support Scheme (LSS): Applications Open Now

Payment Amount: $600.00 per week for full-time workers (20 hours or more per week) and $359 per week for part-time workers (less than 20 hours per week). This is paid as a two-week lump sum.

Eligibility Criteria: This payment applies when you or one or more of your employees must self-isolate on the basis that the employee: has COVID-19, has been identified as a close contact of someone with COVID-19, parent/caregiver of a dependent who has been told to self-isolate, has been directed to self-isolate by a medical officer, is high risk and must self-isolate on doctor’s advice or has household members who are self-isolating as they have been deemed high risk by their doctor. The employee must also not be able to work from home.

Small Business Cash Flow Scheme (SBCS): Applications open now and close on 31 December 2023

Payment Amount: $10,000 to be provided to eligible business plus $1,800 per equivalent full-time employee up to a maximum of $100,000 for businesses employing 50 or fewer full-time employees.

Repayment Terms: This loan is interest-free if repaid in full within the first two years. If this loan is not repaid within the first two years, an interest rate of 3% will apply from the date of inception. The Maximum term on this loan is 5 years. No minimum repayments are required in the first two years.

COVID 19 Support Payment (CSP): NOW CLOSED

Eligibility Criteria: A 40% drop in revenue or a 40% decline in capital-raising ability over a 7-day consecutive period, in comparison to a typical 7 day period in the six weeks immediately prior to and including 15 February 2022, which is a direct result of one or more COVID-19 Circumstances. You must have been in business for at least one month, have a NZBN, be physically present in New Zealand and have taken all reasonable practical steps to minimise the decline in revenue. You can still apply for the CSP if you are also receiving the Leave Support Scheme or Short Term Absence Payment, as long as you still meet the revenue criteria.

Wage Subsidy Scheme (WSS): NOW CLOSED

You must demonstrate a 40% decline in revenue for the relevant 14 day period that relates to each round in comparison to a typical 14-day consecutive period in the six weeks immediately prior to 17 August 2021.

This decline in revenue must be a direct result of the change to alert level 4 and can be calculated on an “invoice basis” rather than a “payments basis”. This means the decline in revenue is calculated based on when you would have performed the work, rather than when you have been paid for work. You must keep evidence of this.

Resurgence Support Payment (RSP): NOW CLOSED

A 30% drop in revenue or a 30% decline in capital-raising ability over a 7-day period, in comparison to a typical 7 day period in the six weeks immediately prior to 17 August 2021, which is a direct result of the increased COVID-19 alert level. Once again this can be calculated on an “Invoice Basis” rather than a “Payments Basis”.

TAX IMPLICATIONS:

Wage Subsidy, Short Term Absence & Leave Support:

GST: This payment is not subject to GST

Income Tax: If you are receiving the wage subsidy for your employees, then that portion of the wage subsidy is not assessable for income tax purposes, however, the Wages that you pay with the subsidy will not be deductible for income tax purposes. If you receive the wage subsidy for yourself as a self-employed owner-operator or as a shareholder-employee, then this portion of your wage subsidy payment will be assessable for income tax purposes in your own name.

Resurgence Support Payment(RSP)/COVID 19 Support Payment(CSP):

GST: You must return the GST output tax on any RSP or CSP received, however, you are able to claim the GST input tax on operating expenditure that was funded by the RSP or CSP, if applicable.

Income Tax: The RSP is not assessable for income tax purposes, however, any payments made towards operating expenses that were funded by the RSP are not deductible for income tax purposes.